Swing Trading: A Profitable Strategy for Smart Traders

Swing trading has rapidly gained attention among stock market enthusiasts for its balance between short-term and long-term trading strategies. It offers traders the opportunity to capture quick price movements in stocks, commodities, and other financial instruments over a few days to several weeks. In this blog, we’ll dive deep into what swing trading is, how it works, its benefits, risks, and essential tips for success.

What is Swing Trading?

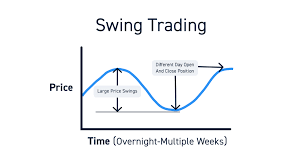

Swing trading is a short- to medium-term trading strategy where traders aim to profit from market swings or price fluctuations. Unlike intraday trading, which involves buying and selling securities within the same day, swing trading positions are typically held for a few days to a few weeks.

The primary objective of swing traders is to identify trending stocks or assets and capture potential gains during upward or downward price movements. This strategy relies on technical analysis, chart patterns, and market trends to make informed trading decisions.

How Does Swing Trading Work?

Swing traders use a mix of technical indicators and price action analysis to determine the best entry and exit points. Common tools used by swing traders include:

Moving Averages (MA)

Relative Strength Index (RSI)

MACD (Moving Average Convergence Divergence)

Support and Resistance Levels

Candlestick Patterns

For example, if a stock breaks above a strong resistance level and shows positive momentum, a swing trader might buy the stock, aiming to sell it once it reaches a new high within a few days.

Swing traders typically avoid holding positions for months, focusing instead on short-term price trends and patterns.

Advantages of Swing Trading

Swing trading offers several benefits that appeal to both new and experienced traders:

Time-Efficient: Unlike intraday trading, swing trading doesn’t require constant market monitoring. Traders can check their positions a few times a day.

Flexible Strategy: Suitable for part-time traders who can’t commit to full-time trading.

Higher Profit Potential: By capturing short-term price movements, traders can accumulate decent profits in a short time.

Defined Risk Management: Stop-loss orders and pre-set targets help manage risks effectively.

Risks Involved in Swing Trading

Like any trading strategy, swing trading comes with its own set of risks:

Market Volatility: Sudden news or market events can cause rapid price fluctuations.

Gap Risk: Holding positions overnight exposes traders to price gaps caused by after-market news.

Emotional Decision-Making: Market swings can lead to impulsive decisions if emotions aren’t kept in check.

Requires Knowledge of Technical Analysis: Successful swing trading depends heavily on understanding charts, patterns, and indicators.

Key Tips for Successful Swing Trading

To maximize success and minimize losses, here are some essential tips for swing traders:

1️⃣ Focus on Liquid Stocks

Always trade in stocks or assets with high trading volumes to avoid liquidity issues.

2️⃣ Use Stop-Loss Orders

Protect your capital by setting stop-loss orders for every trade to minimize potential losses.

3️⃣ Stay Updated on Market News

Economic data, company earnings, and geopolitical events can influence short-term price movements.

4️⃣ Avoid Overtrading

Don’t force trades when the market is uncertain or doesn’t present clear opportunities.

5️⃣ Keep a Trading Journal

Record your trades, strategies, and outcomes. This helps in refining your approach over time.

Conclusion

Swing trading offers an exciting opportunity to profit from market fluctuations without the stress of daily intraday trading or the patience required for long-term investing. With the right knowledge, tools, and discipline, swing traders can achieve consistent and meaningful returns.

If you’re looking to start your swing trading journey, begin by mastering technical analysis, following market trends, and developing a solid risk management plan.